Update strategische roadmap

Dit is een update over de strategische roadmap van Strukton Groep. Wij liggen op koers in onze strategie voor duurzame infrastructuur in Europa. Samen met opdrachtgevers en partners nemen we duurzame initiatieven, we verbeteren ons risicoprofiel en maken ons bedrijf toekomstbestendig. In dit Engelstalige bericht lees je hier meer over.

Strukton on track with strategic roadmap to future-proof the company

Strukton is on track with its strategic roadmap ‘sustainable infrastructure in Europe’. We are taking sustainability initiatives with customers and partners, and we are significantly de-risking and future-proofing the company. An element of this is our decision (2021) to no longer start new major project operations outside Europe. We are now accelerating this path in 2023, by taking action towards ceasing such existing operations, especially in the Middle East.

Strukton is on track with its strategic roadmap ‘sustainable infrastructure in Europe’. We are taking sustainability initiatives with customers and partners, and we are significantly de-risking and future-proofing the company. An element of this is our decision (2021) to no longer start new major project operations outside Europe. We are now accelerating this path in 2023, by taking action towards ceasing such existing operations, especially in the Middle East.

Strukton has made considerable steps since initiating major improvements in the company and the overall strategy. Dutch divisions have been reorganised and organisational layers are reduced. And the governance model of the organisation is strengthened. This transition is backed by the implementation of new group-wide controls and investments in IT. “There is collective realisation that further improvements must be made to Strukton and the earning capacity of our operations”, according to Strukton’s CFO Arthur Vlaanderen.

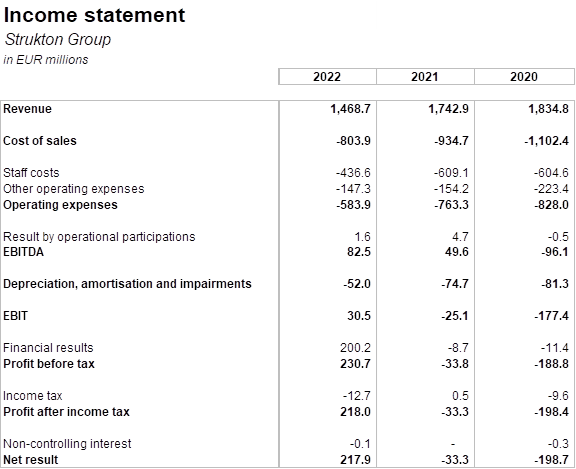

Together with our auditor Mazars we are working on the audits of the financial statements 2020, in close dialogue with the Supervisory Board. Today, we announce preliminary positive operational results for 2022 (unaudited). The (unaudited) 2020 net results are severely negative, followed by a considerable loss in 2021 (unaudited). This is due to particular projects and significant non-recurring costs for operations in the Middle East that we are winding down. The quality of the balance sheet of Strukton has since been strengthened with the strategic divestment of Worksphere in 2022, and the substantial repayment of our bank debts. The 2022 results are preliminary and subject to future developments and audit, which also applies to the years 2020 and 2021.

Focus on sustainable infrastructure in Europe

In the course of 2021, Strukton recalibrated its corporate strategy for the short and long term, focusing its presence almost exclusively on the European Union and strengthening its position as a sustainable infrastructure specialist service provider. The renewed strategy marks a return to Strukton’s rich history, building on a century of expertise. Strukton aims to be leading in the transition to a fossil-free European society, contributing to green transportation and electrification. The rail-related activities will play an increasingly important role, with support from specialist civil-engineering activities organized in four distinct product-market combinations. Our structure and organisation has been adjusted to reflect this focus and we are embedding the new strategy in how we do business.

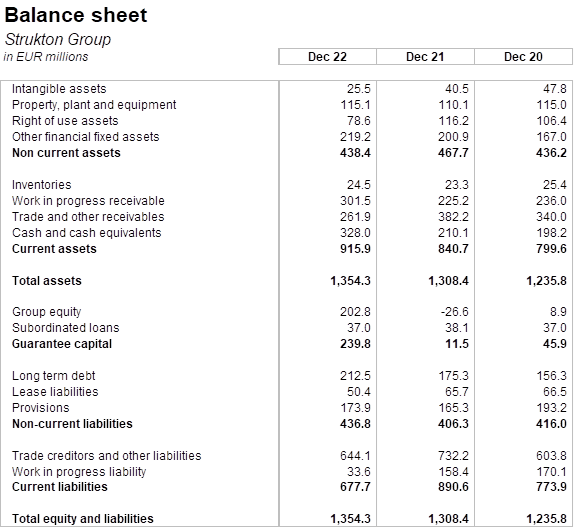

Materialised solvency boost in 2022

In line with the strategic roadmap, Strukton has divested ‘Worksphere’, a relatively stand-alone business active in maintenance of accommodation and the built environment. The transaction was completed in January 2022. The division was sold for a purchase price of over EUR 220 million or 11.3x EBITDA and led to a transaction result of nearly EUR 200 million. This led to a boost of 15% in the solvency. Strukton utilised the cash proceeds amongst others to repay cash facilities in January 2022 and substantially strengthen its capital base as of that date.

More responsible financing structure

Since the divestment, financing requirements mainly comprise (bank) guarantees, transaction banking, (equipment) lease and transactions. For now, the non-recourse project-financing for RIVM and the ringfenced facilities in Italy are left intact and continue to exist at time of writing. Other cash or credit facilities are repaid, reduced or not materially utilised. The strengthened financial position as of 2022 results in financing requirements substantially lower than industry standards.

Preliminary financial results

The positive result in 2022 was led by consistent operational performance particularly in the European rail business units. Nonrecurring results like minor disposals of real estate, as well as the Worksphere transaction supported a robust positive bottom line for the year. The 2020 net results are severely negative, followed by a still considerable loss in 2021, both taking into account recent subsequent events analysis. Therein it was Dutch division Strukton Civiel’ disappointing contributions to the result, particularly project Hoofdstation Groningen that had considerable impact. Continuous measures regarding vibration-proofing the building for the Dutch RIVM project contributed negatively as well. Strukton International though contributed negatively the most, accounting for significant write-offs to reflect a deteriorated (legal) situation in Saudi Arabia related to the Riyadh metro project. Strukton has therefore decided to accelerate its strategic decision to withdraw from major project operations in the Middle East and the company is on track with its strategic roadmap to significantly de-risk and reform the company. Our presence in loss-making segments has been reduced and we have materialised significant steps to align our organisation to our earnings capacity. These steps and a strong orderbook are expected to contribute to a positive financial performance for 2023.

A material uncertainty in the figures is the pending dispute resolution on the RIVM project. The project is delayed by a number of laboratory change orders from the client, who disputes the significant financial consequences resulting therefrom. Currently the dispute is being considered by a committee of experts. The outcome of the dispute resolution, which may significantly impact Strukton’s results 2020 onwards, is uncertain.

Strukton’s CEO Gerard Sanderink: “I am proud of the determination and effort of our team to achieve these state-of-the-art laboratories and contribute to the important work of the RIVM. We are confident that our rights under the contract will be honoured and that the costs related to these complex change orders on the RIVM-project will be awarded in full.”

Audit status

Due to capacity constraints in the Dutch audit market, late appointment of the new auditor Mazars, organisational complexity of Strukton and the ‘first year audit’, the audit of most Dutch subsidiaries and the consolidated accounts regarding 2020 has taken much longer than desired. The professionalism and constructive attitude of Mazars and the Strukton finance team has led to a good cooperation. Audit completion for the year 2020 is currently prognosed per end of March 2023. The timeframe will also impact the completion of the audit works regarding 2021 and 2022. Auditing financial years 2021 and 2022 will likely take an additional year after completion of 2020, although we are investigating ways to deliver earlier on this timeframe. Strukton’s subsidiaries in Italy, Belgium, Denmark and Sweden have audited financial statements for all recent years until 2021 and 2022 audit is under process.

Gerard Sanderink concludes: “The past years were difficult, in more ways than one. It was necessary to take responsibility and action. We stepped up to the challenge and seized opportunities to initiate major improvements in our company and our overall strategy. Though there are still many steps to take, we are satisfied that our company already has materialised on major steps in future-proofing our organisation. We are committed to further build upon this foundation.”

Key financials (unaudited)

Click here for a pdf of this update.